Signal Strength: Mixed.

After a good start to 2020, the last two weeks of January were marked by growing fears about the coronavirus, as equity markets dropped and a flattening yield curve once again raised recession fears.

January Market Review*

The S&P 500 Index returned -0.04%.

The Bloomberg Barclays U.S. Aggregate Bond Index returned 1.92%.

Fed Funds Target Range: 1.50 – 1.75% – unchanged.

Stocks started January with positive momentum, continuing the trend from last year’s strong performance. However, by mid-month, the global impact of the coronavirus became clear and markets turned negative for the last two weeks. As the World Health Organization declared the virus a public health emergency of international concern, investor concerns resulted in the biggest equity market pullback since October. The CBOE Volatility Index or VIX (the so-called “fear index”), jumped more than 36% in January.

The flight from riskier assets resulted in a flattening of the yield curve as the 10-year U.S. Treasury yield dropped from 1.88% on January 2nd to 1.52% by month-end. It inverted against the 3-month Treasury bill, which was yielding 1.55%. This marked the lowest level for the 10-year Treasury in five months. The re-inversion of the curve, of course, raised again the specter of recession.

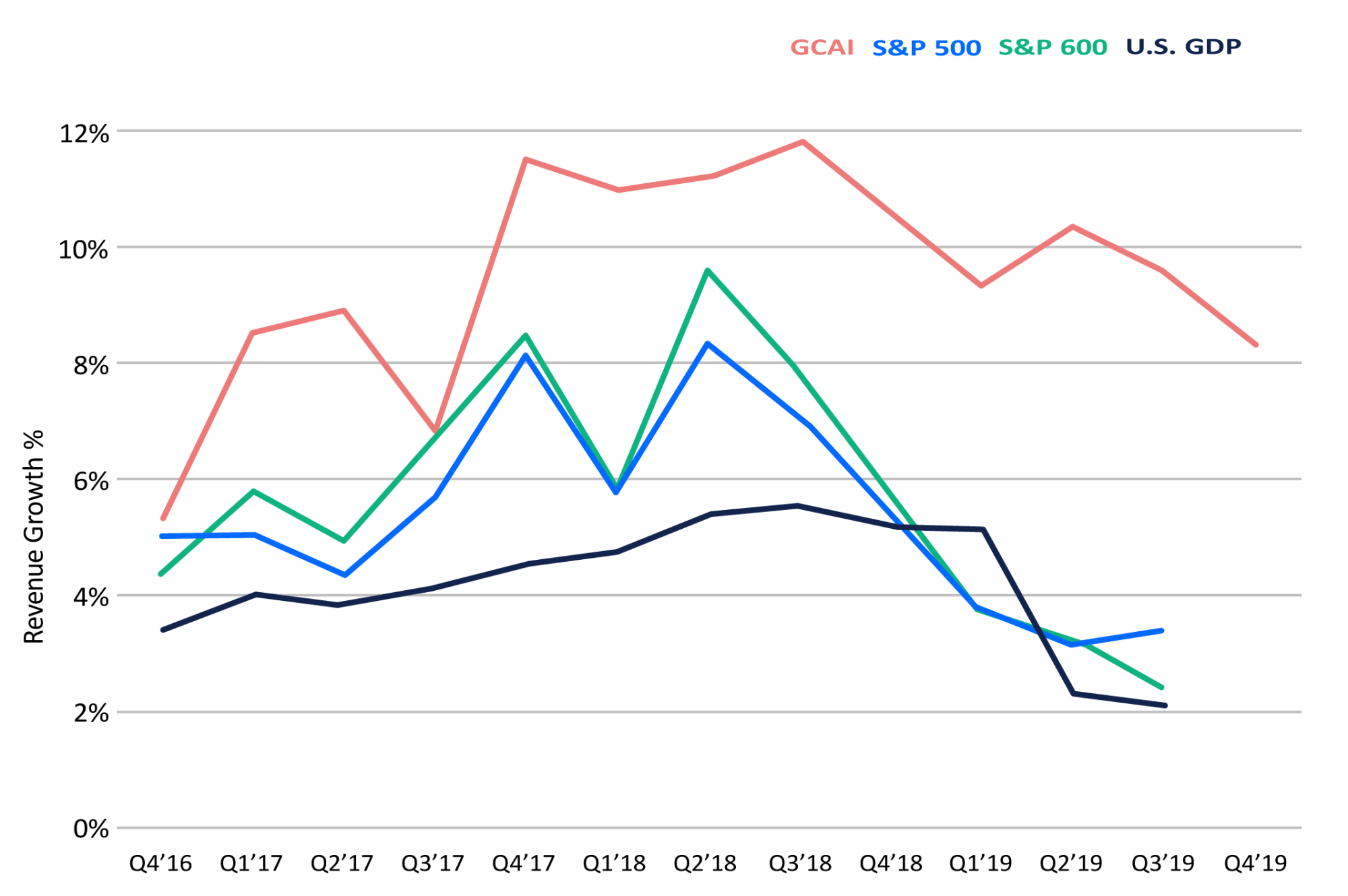

The Fed was able to reassure skittish investors. It kept rates unchanged as Powell’s statement noted that the coronavirus threat has not altered the Fed’s monetary approach. Further, the Fed announced that cash injections into the repo market would continue “at least through April.” The initial estimate of fourth-quarter U.S. GDP growth came in at 2.1%, extending a recent run of modest quarterly gains. GDP growth suggests that the economy has some runway left and that the Fed will continue to remain neutral.