Is Inflation Really Cooling?

Signal Definer: Strong. Equity markets recovered significant ground, and most major bond sectors saw rare (in 2022) positive results.

Is Inflation Really Cooling?

Signal Definer: Strong. Equity markets recovered significant ground, and most major bond sectors saw rare (in 2022) positive results.

The S&P 500 Index returned 9.11%

The Bloomberg U.S. Aggregate Bond Index returned 2.44%

Fed Funds Target Range: 2.25% – 2.50%

The Fed raised the key short-term rate by an expected 75 basis points, and in his remarks Chairman Powell used the phrase “in the pipeline” to describe the potential that rate increases already enacted may not have filtered into the economy yet. His remarks were interpreted as newly dovish, and this was enough for some to begin planning a “rate cuts in 2023” party.

The data shows growth slowing and the Fed’s preferred measure of inflation increasing, but income is up and consumers are more positive.

The headline CPI print came in at 8.5%, lower than expectations. The decrease in energy costs was enough to offset increases in food and shelter. Core CPI, excluding energy and food, increased 0.3%. This was lower than the increase in April, May, and June.

The S&P 500 rallied sharply on the prospect of a more dovish Fed and positive earnings results and guidance. As of month end, 278 issuers have reported, with 209 beating estimates (75.2%) and 67.9% beating estimates on sales. Overall Q2 earnings are expected to post a 7.3% increase over Q1 2022.

The 10-year U.S. Treasury ended the month at 2.66%, down from 2.98% in June. At year-end 2021, this rate was at 1.51%. The 30-year U.S. Treasury ended July at 3.02%, down from 3.19%. The Bloomberg U.S. Aggregate Bond Index ended July with a return of 2.44% but is still down year-to-date with a return of -8.16%.

The U.S. high yield market returned 6.02% as measured by the ICE BofA US High Yield Constrained Index . Year-to-date, the market returned -8.86%. Bonds rallied on relatively strong Q2 earnings reports from high yield issuers, along with the emerging view that a slower economy could lead to less aggressive Fed tightening in the second half of the year.

S&P Global’s recent LCD Leverage Finance Survey looked at the sentiment of leveraged finance professionals with respect to defaults. Leveraged finance professionals expect the loan default rate, as measured by the S&P/LSTA Leveraged Loan Index, to rise from a near record low of 0.21% in May to between 1% and 1.49% by June 2023. This still sits well below the long-term average of 2.77%.

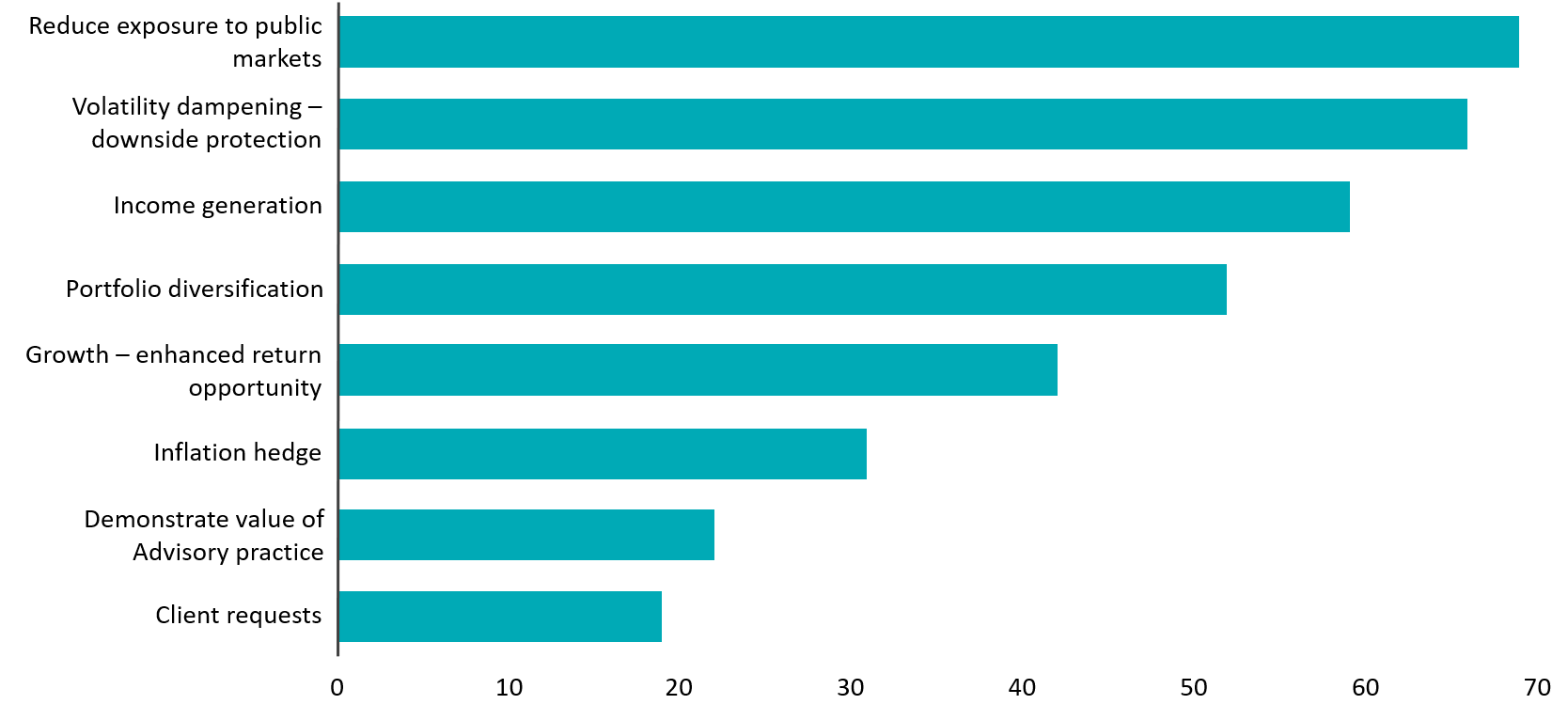

A new survey looks at the changing landscape for alternatives, as more advisors look to increase allocations.

Source: Cerullii Associates/Blue Vault June 2022

Source: International Energy Agency; Forbes, National Confectioner’s Association

Building an Engaged Audience on Social

Read More >>Sign-up for The Signal, a monthly rundown of what moves took place in the credit market and our latest educational and thought leadership content.

CION will use the information you provide to be in touch with you and provide updates. Feel free to change your mind at any time by clicking the unsubscribe link the email you receive. We will never share your information and will treat it with respect.