The Signal

All Trick, No Treat?

The Signal

All Trick, No Treat?

The S&P 500 Index returned -9.3%

The Bloomberg U.S. Aggregate Bond Index returned -4.32%

Fed Funds Target Range: 3.00% – 3.25%

The Fed raised the key short-term interest rate by another 75 basis points at the September FOMC meeting, but the big news wasn’t the well-anticipated rate increase. It was Chairman Powell’s remarks at the press conference. He went well beyond any previous statements about the central bank’s level of commitment to fighting inflation. Powell focused on getting to a restrictive level of monetary policy, quickly. He defined “restrictive” as a level that puts meaningful downward pressure on inflation. This was interpreted by markets as putting a soft landing for the economy at substantial risk, if not making it impossible to achieve.

Let’s get into the data:

The lack of progress on inflation, and the flatlining, but not decreased, consumer spending has raised the potential for a recession caused by the Fed’s aggressive rate increases.

Market Review

September lived up to its reputation as the bad month for equity markets, as the S&P dipped below the June low. The Dow officially entered a bear market, as it was down 21.94% from its Jan. 4, 2022 high. The Q2 2022 earnings season ended, with preliminary results showing 372 issues beating estimates. Third quarter earnings estimates are estimated to decline by 7%, but Q4 is the biggest concern as ongoing inflation, pullbacks in consumer spending and Fed rate increases begin to have significant impact.

The 10-year U.S. Treasury ended the month at 3.81%, up from 3.17% in August. The 30-year U.S. Treasury ended August at 3.78%, up from 3.28%. The Bloomberg U.S. Aggregate Bond Index ended September down 4.32%. The year-to-date return at month end was -14.60%.

The U.S. high yield market dropped 4.02% in September, bringing the YTD return to -14.61%, as measured by the ICE BofA U.S. High Yield Constrained Index.

The U.S. leveraged loan market, as represented by the Morningstar LSTA U.S. Leveraged Loan Index was down 2.27% in September, for a year-to-date return of -3.25%. The asset class is still well ahead of longer-duration assets such as corporate bonds. Investment grade corporates returned -5.26%, bringing the year-to-date return to -18.72% for the Bloomberg U.S. Corporate Investment Grade Index

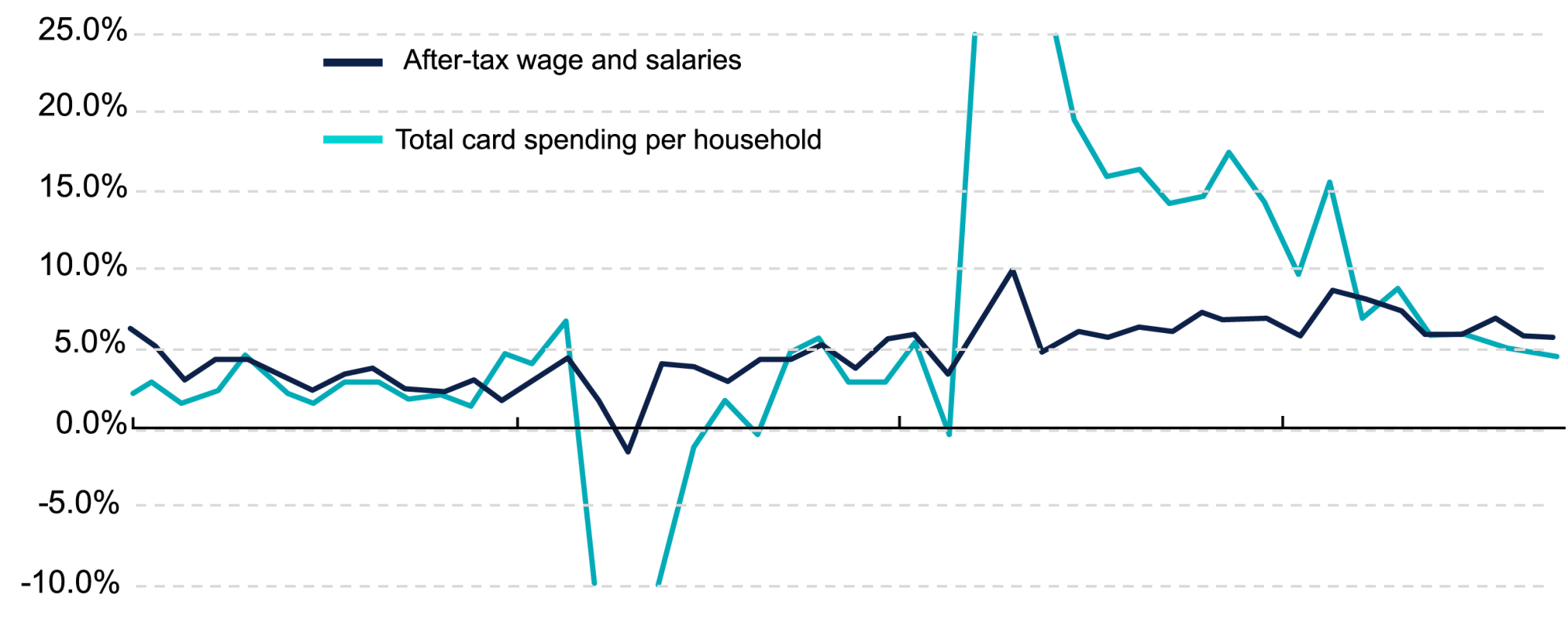

Bank of America reports that after-tax wages are still outpacing credit card spending.

Source: Bank of America. Note: April 2020 and April 2021 data points aren’t shown in the chart due to high volatility.

Source: NBER, CNBC/DataTrek, Politico

Scaling Client and Prospect Engagement: A Guide to Launching an Educational Platform for Your Niche

Read More >>Sign-up for The Signal, a monthly rundown of what moves took place in the credit market and our latest educational and thought leadership content.

CION will use the information you provide to be in touch with you and provide updates. Feel free to change your mind at any time by clicking the unsubscribe link the email you receive. We will never share your information and will treat it with respect.