Signal Strength: Choppy.

Tension around the election and reports of rising coronavirus cases, along with the continued failure to reach an agreement on another stimulus, weighed on markets.

October Market Review*

The S&P 500 Index returned -2.7%

The Bloomberg Barclays U.S. Aggregate Bond Index returned -0.45%

Fed Funds Target Range: 0 – 0.25%

In retrospect, maybe the muted Halloween this year was a good thing. Between spikes in coronavirus cases and growing uncertainty around the election, the headlines that drove markets were basically a month-long series of jump scares.

Just like scary movies always start with everyone happily going about their business, the economy cooperated with an absolute slew of positive data releases. The Institute for Supply Management’s latest survey of manufacturing showed new orders jumping to their highest level in nearly 17 years. The Conference Board’s Measure of CEO Confidence for September was up sharply to 64, from 45 in July. FactSet reported a high percentage of S&P 500 companies with positive EPS surprises in 3Q. Employment growth, while slowing, stayed positive. And towards the end of the month the Great Pumpkin of economic data, GDP, came out and showed an increase at an annual rate of 33.1%.

The scary bits? Stimulus talks ramped up, then dropped on pronouncements from the various actors involved. It finally became apparent that any stimulus would most likely wait until after January 20th. Election polling provoked both eye-rolling and handwringing, for the markets and the rest of us. And the Coronavirus continued to spread like increasingly thick fog.

Equity markets finished lower for the second month in a row. Tech stocks, which have had a historic run this year prior to October, faltered and ended up behind all other sectors. The energy sector underperformed as well, and mega cap growth stocks stumbled as investors shifted to value-oriented and small cap stocks.

Yields were volatile throughout the month, resulting in almost weekly selloffs that were then recovered the following week. By the end of the month, the Treasury yield curve had steepened considerably, bringing the difference between 30-year and 5-year yields to the highest level since 2016. The 10-year Treasury note yield rose 18.1 basis points in October and the 30-year bond yield climbed 18.4 basis points.

The only sector with positive performance outside of short duration assets (ABS and 1-3 year Gov’t Credit) was high yield, with the Bloomberg Barclays High Yield Index returning 0.51%.

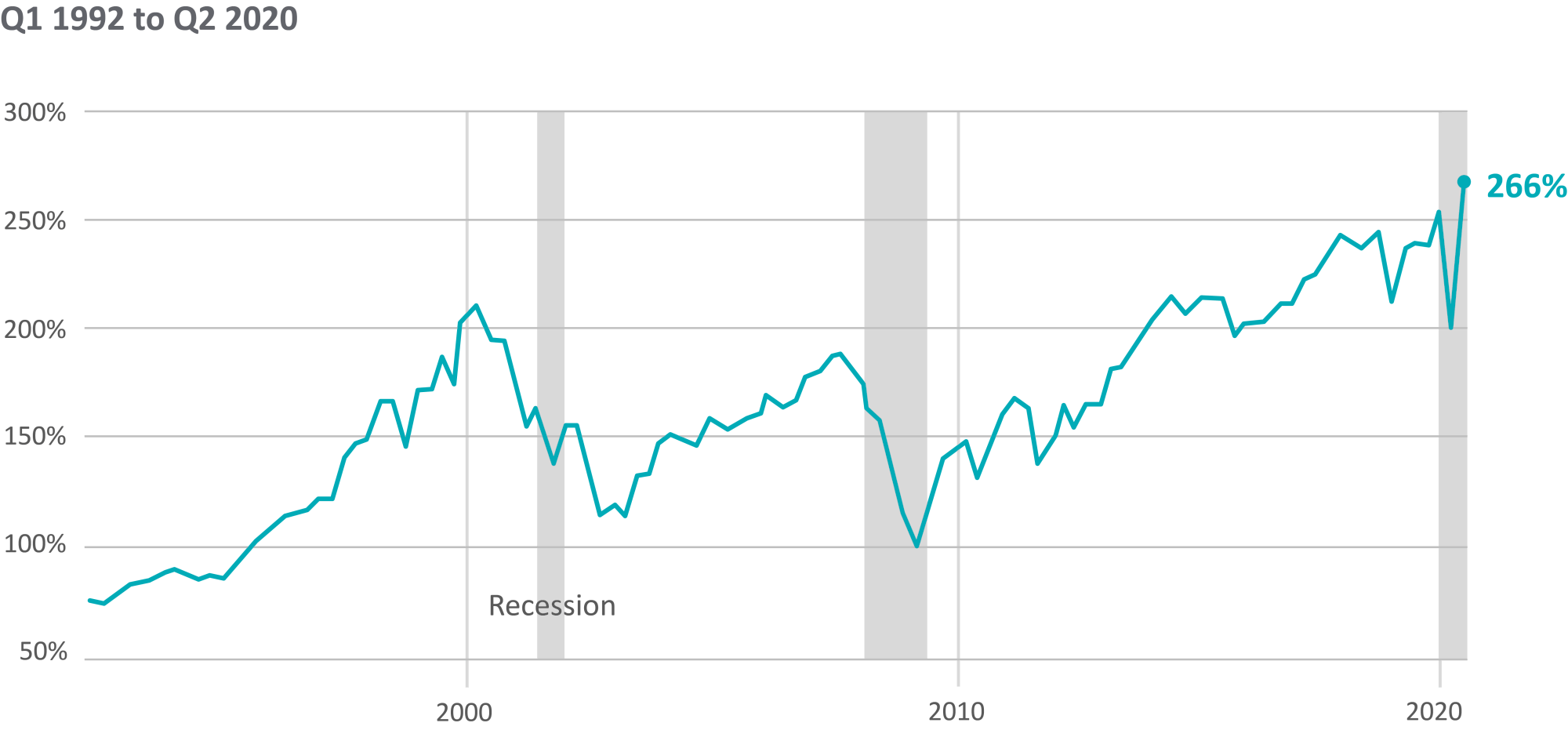

In illiquid assets, Preqin reported that for the three months ending in March (the latest quarter for which performance information is available) across all private debt strategies, longer-term horizon IRRs (three years plus) have proven to be stable, with little variation. Private debt is outperforming real estate and natural resources private capital strategies.

For the 3rd quarter, Preqin reported that fund managers were seeking record amounts of capital in the private debt market, with an aggregate $295bn targeted. This represents a 54% increase compared to January 2020, when funds on the road were looking to raise $192bn. The average size of funds in market is also increasing, given that the number of funds in market grew by 19% over the same period, from 436 to 521 – also a new record.

With Election Day over, the markets are more optimistic about the likelihood of a stimulus package and the potential for other spending. To date (November 11), we are seeing markets respond positively to the, at least partial, relief from uncertainty.