Signal Strength: Strong.

Stocks and bonds achieved standout returns for the year, the economy pushed recession fears into the rear-view mirror and a trade deal started to look possible.

December Market Review

The S&P 500 Index returned 2.86%.

The Bloomberg Barclays U.S. Aggregate Bond Index returned -0.07%.

Fed Funds Target Range: 1.50 – 1.75% – unchanged.

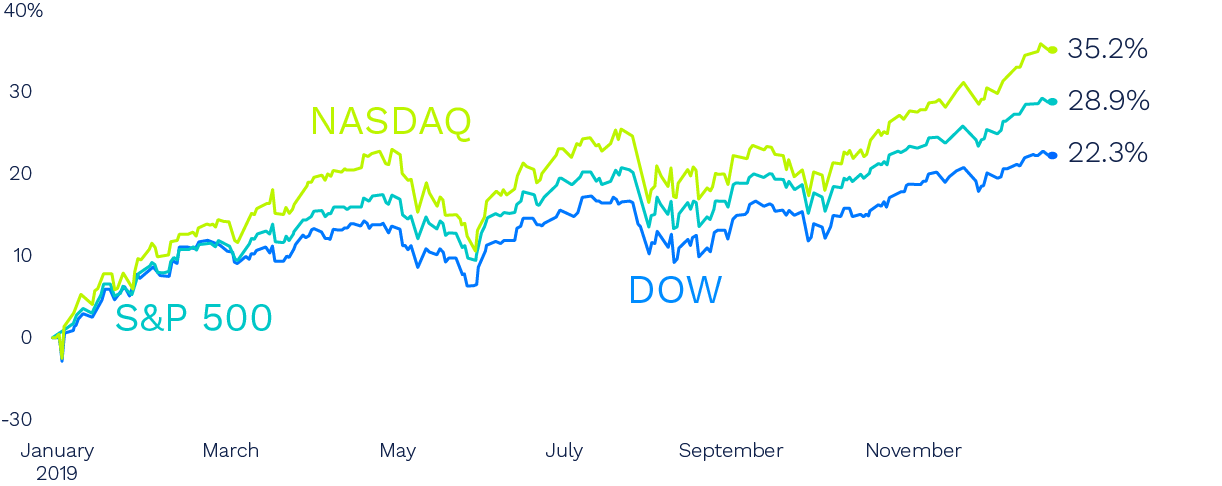

The S&P 500 and the Nasdaq Composite had the biggest annual gains since 2013 — 29% and 35%, respectively. The outperformance was even more remarkable given that the gains were despite somewhat lackluster earnings per share growth, plus a relentlessly negative news cycle and the looming shadow of recession.

However, the potential for a “phase one deal” between the U.S. and China prevented new tariffs from being enacted in December and reduced existing tariffs. This, along with China’s two-year, $200 billion commitment to increase purchases of primarily U.S. agriculture goods, was enough to keep markets humming along. Meanwhile, concerns emanating from the news cycle, including the impeachment vote, were shrugged off by the equity market.

The 10-year Treasury ended the month yielding 1.92%, while the 3-month to 10-year yield spread returned to a more normal shape. That is, the yield on short maturities is now lower than the yield on longer maturities. This “de-inversion” of the yield curve further reassured investors. The Bloomberg Barclays U.S. Aggregate Bond Index was slightly negative on the month at -0.07% and the Bloomberg Barclays U.S. High Yield Index returned 2.00% during the month.

For an in-depth review of equity and bond performance, check out our Q1 Outlook.